Considering that the lifeline of any business is money, it is pretty important to ensure you bill your customers properly and get paid for the work you do. When I first arrived at influencers@, I had no clue how to do billing properly and my invoices got a snicker or two from customers. Through trial and error, I’ve pinpointed some best practices for billing. For new business owners and operators, feel free to leverage these and make your billing rock.

1. Be plain and clear

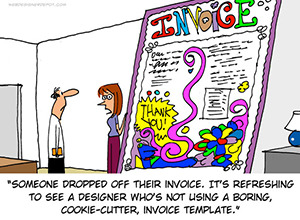

I remember when I sent an invoice to Ryan Durkin at Dailybreak and he said something along the lines of “Yeah, my invoices used to look like this too.” It turns out, lots of colors and a sleek design are NOT appropriate for invoices. On the contrary, accountants and operators want the bare minimum: just clear information like the date, invoice #, services rendered and amount due. Skip the fluff.

2. Bill in regular intervals

Most companies pay their bills in regular intervals, so match that with your billing cycle. Sending an invoice weekly can be extra work for your customers, and many of them will only pay once or twice per month. To find a balance between managing cash flow and making my customer’s lives easy, I bill on the 15th and 30th of each month.

3. Set your terms: net 15

Invoices should specify how long a customer has to pay, and potentially offer a small discount for paying early. I usually set my invoices at a term of net 15, which means that my customers are expected to pay within 15 days of the date of the invoice.

4. Gather the tools: Quickbooks

I started with making invoices by hand in Google Docs and Adobe Indesign. Please do not ever do this! Instead, turn to accounting software like Quickbooks Online that manage your invoices, expenses and payroll under one roof. Quickbooks makes it easy to create and send invoices straight to your customers.

5. Deliver electronically

In today’s day and age, invoices should be delivered via email to your customer’s Accounts Payable department, while also CCing your primary contact at the company so they are kept in the loop. I send these invoices from my own email account so customers can reply directly if they have any questions regarding the charges.

6. Allow customers to pay via check & electronically

Most customers will pay invoices via a check. However, for convenience, consider leveraging an online payment system that enables your customers to pay via a bank transfer or credit card. Intuit has one of these systems that integrates right into Quickbooks, and it costs only $0.50 per transaction (no % fee, for real!)

7. Follow up when bills are not paid

Occasionally, a customer might lose your invoice or forget to pay. If so, a friendly reminder via email or call can be used to remind them and ensure that the payment is processed. Quickbooks shows a list of all unpaid invoices and the amount of days outstanding for each, so this can be used as a checklist for which customers need to be followed up with.