There’s a problem at many startups:

We spend too much money.

With the decade long bull market and excessive fundraising environment, unprofitable startups are gobbling cash at a remarkable pace. The mantra is “grow as fast as possible, raise the valuation, figure out profitability later.” That can certainly work for some, unless the music stops. If there are unforeseen circumstances — a new product doesn’t work or the business model shows some flaws — that spigot of never ending money may stop flowing.

I felt this pain acutely at my last startup. We grew quickly and let hefty expenses, many for products and services that we didn’t even need, pile up. Our leadership team was eager to add more staff to scale, but we didn’t carefully consider how the additional costs would reduce our runway and increase our risk, especially if revenue did not grow as quickly as we projected, or if we couldn’t collect accounts receivables promptly. Not surprisingly, we encountered both of those obstacles. This forced us to make layoffs, which is agonizing for everyone involved. It was a valuable lesson learned and shaped my current philosophy on cost management.

At Crystal, we take a disciplined, analytical and no-nonsense approach to managing our operational expenses. While this methodology is most feasible for smaller organizations (i.e. 1-30 people), the concepts can be baked into the culture of any size company. For simplicity, I use the terms “expenses” and “costs” interchangeably throughout this article. Here’s a breakdown of the strategy our team uses, and how you can use it too:

1. Audit your expenses by vendor monthly

In order to effectively manage operational costs, you first need to understand what they are. While some organizations have a dedicated CFO for this, I believe it’s also the co-founder/CEO/President’s responsibility to understand exactly how the company’s money is being spent. If you have a great accountant (we use Crabtree Rowe & Berger) that categorizes your expenses in an accounting system (we use Quickbooks Online), than this will be easy.

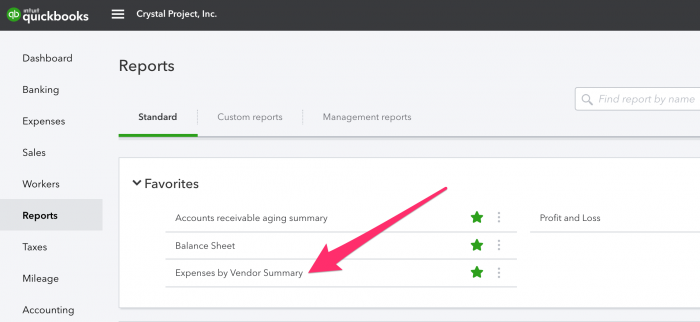

I do this monthly, and start with an Expenses by Vendor Summary report. If you use Quickbooks, you’ll find it here:

This report breaks down every vendor you spent money with in a period. I sort by the largest expenditures first, and ensure I understand what they are. For most startups, these will be payroll, health insurance, legal and if you’re in software, infrastructure (e.g. Amazon Web Services). This quick glance enables me to see all of our costs for the period, where we spent the most, and that those costs align with our goals and objectives.

2. Question the really big costs

One year ago, our bill for Amazon Web Services was one of our largest expenses. Crystal is growing fast and our technical infrastructure needs to scale to handle our increasing user-base. However, given that it was one of our highest monthly expenses, it warranted scrutiny. Luckily, my colleague Jonathan on our engineering team is an Analyst personality type (which means he loves finding efficiencies). After digging into our Amazon Web Services costs, sure enough, he found that we had servers running that we didn’t need, settings turned on that were unnecessary and wow did these little things add up. When he was done, our bill fell by a whopping 60%.

This story illustrates why it’s so useful to scrutinize big expenses. With items as complex as server infrastructure, it’s easy for costs to balloon over time without much thought or oversight. We dedicated a relatively small amount of time in our engineering roadmap for Jonathan to investigate, and the payoff was tremendous. Questioning big costs and digging into why they are there is an important aspect of a positive financial culture at a startup.

3. Centralize subscriptions

Small software subscriptions seem innocent — a few hundred dollars here and there — but eventually they add up to become substantial. Without any oversight, it’s too easy for anyone in the organization to purchase subscriptions on a company credit card, and then forget about them. If your accounting team doesn’t have the context to audit each one, many unnecessary subscriptions will keep getting billed. You can identify subscriptions using the Expenses by Vendor Summary report I mentioned earlier, and see them by category in your Profit & Loss report.

Consider creating a policy that requires all subscriptions to be charged to a few specific corporate credit cards (or even just one card). You don’t want to add excessive bureaucracy, but you also need a way to keep expenses under control. Additionally, you may consider a tool like Blissfully that makes it easy to visualize and manage an entire company’s subscriptions from one dashboard.

4. Be vigilant about waste

An important step in keeping operational costs under control at a startup is building a culture that abhors waste. Whether it’s a software subscription that’s not used, a marketing event that never has ROI or hiring an unnecessary consultant, the team needs to understand the consequences of overspending. While it certainly won’t kill the company to have an extra $50/month subscription on a corporate credit card, it’s more a matter of principle. If it’s acceptable to have unnecessary subscriptions, why should we bother to look into why the Amazon Web Services bill is so high?

This should be set by example from the leadership team. Ask yourself:

- Do we carefully consider how each expense will impact our bottom line?

- Do we cancel expenses when they are no longer needed?

- Do we avoid long-term contracts that force us into expenses even if business conditions change?

5. Discuss expenses openly, especially with leadership

In order to make informed decisions, the team needs to be informed. Everyone in the organization that has spending or hiring authority should know the current revenue, expenses, and profit/loss. Anyone who is hiring someone for their team needs to understand the cost impact of making that hire, e.g. “if I add another member to this team, it’ll cost $X,000/month. What item will we not be allocating budget to because we hired this person? What will this person do if the growth we expect next quarter doesn’t happen?”

While making department level budgets is a great step, it’s also important that functional leaders understand how their budget plays into the broader picture. Especially at a small startup, spending decisions should be made with a cross-functional perspective, e.g. “we could spend $X to go to this conference, or we could hire another engineer which would speed up product development.”

Ultimately, good cost management comes down to having a bias towards operating conservatively. Consider the impact before making an investment, and know the numbers. Overspending feels great when times are good, but can be a company-killer when times are bad.